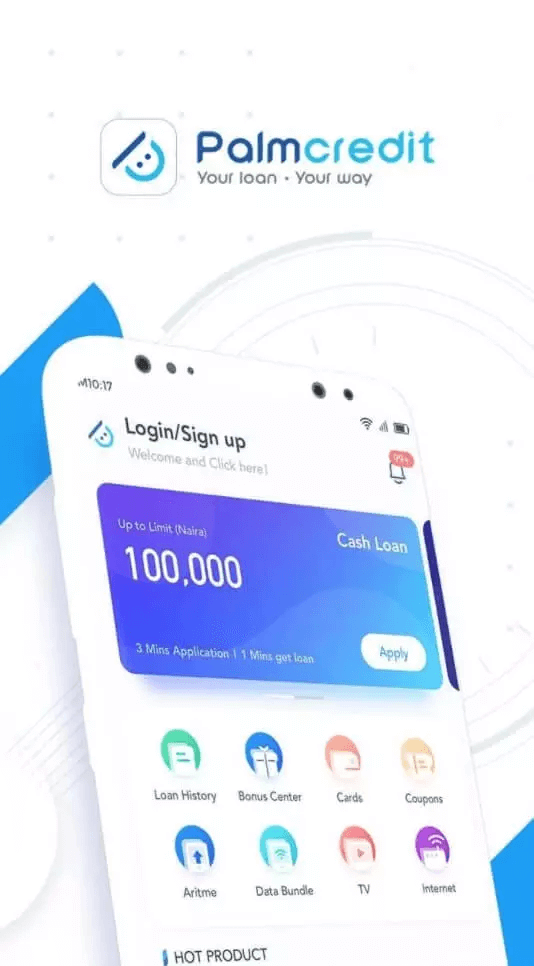

Palmcredit Loan: How To Apply For A Loan From Palmcredit – 2023

Do you need a fast loan to meet a financial need? Sometimes we may be confronted with an unforeseen financial situation and want a fast loan to meet unpaid expenses. In this case, a standard bank loan may not be the best option.

Instead of going to a bank to apply for a loan and dealing with all the paperwork, applying for a short-term fast personal loan on an online platform like Palmcredit is more straightforward.

Palmcredit is a Nigerian online platform owned by Newedge Finance Limited, and they provide rapid loans up to N300,000 with no collateral. Nigerians may use Palmcredit to get a loan from anywhere in the country.

The loans are normally offered at a cheap interest rate, making it one of Nigeria’s top rapid loan providers. You must first download the Palmcredit app in order to apply for the loan.

Related Post: I Need a Loan of 50000 Naira. (The Best Way to Get It)

Palmcredit Loan Application Criteria and Requirements

Before a borrower is qualified for a loan from Palmcredit, they must satisfy certain requirements, which include the following:

Age: To apply for the Palmcredit loan, you must be at least 18 years and above to be eligible to collect a loan.

Bank Account: Every borrower must have a three-month-old bank account with any licensed commercial bank to borrow money from Palmcredit.

BVN: Your BVN is your 11-digit verification number that links to all your bank accounts; you’ll need to provide it before being offered a loan.

Phone Number: Palmcredit will need your phone to verify your account for verification purposes.

Also Read: SMEDAN Registration: Step-by-step Guide on How to Register your Business -2022

How Do I Apply For A Palmcredit Loan?

1. Get The Palmcredit App On Your Phone: The Palmcredit app may be downloaded in two ways. The initial step to take is to go to their official website. To download the app, you will need to enter your phone number. The second option is to download the app from the Google Play Store directly.

2. Complete Your Registration: After completing your installation, the following step is to register. On the screen, there will be directions that you must follow. Follow the steps and provide all the necessary information. You’ll also be asked to verify your phone number. Palmcredit will send you a code to your phone. Input the code into the app to finish the verification process.

3. Fill Out A Loan: You may apply for a loan once you have finished your registration. The procedure is simple. You’ll see where to click right there on the app.

4. Obtain Approval: All you have to do now is wait for the loan to be granted once you’ve applied. It usually just takes a few minutes to do this process. Just make sure you fill out all of the required fields. You will be given the loan after you have received your approval. You have the option of immediately depositing the funds into your bank account.

Palmcredit Interest Rates And Loan Duration

The interest rate on a PalmCredit loan ranges from 4% to 24%. Palmcredit, for example, charges a monthly interest rate of 4% if you pick a 6-month loan and borrow N200,000. If you do the math, your total interest for the six months is NGN48,000. After 180 days, you would have paid a total of NGN 248,000.

It’s worth noting that the longer the repayment time, the more money you’ll have to pay back. For example, if you borrowed NGN 10,000 for a month and the interest rate was 20%, your interest would only be NGN2,000. So you’re repaying NGN 12,000 in a month; if you make your payment, you’ll get additional interest.

Palmcredit can lend you up to $100,000. Also, keep in mind that the maximum amount may be changed!

Related Article: 7 Instant Loan without BVN in Nigeria

Palmcredit Loan Repayment

It is relatively simple to repay a loan. You have to open the app and log in—select my loans’ from the drop-down menu. You may then choose how much you wish to pay back. Your card may be used to make the payment immediately on the app.

If you cannot return your loan using the app, you may pay it back using their account number. Please note that you should contact their customer service department before or after depositing into the account.

To Make a Direct Bank Transfer

You may deposit or transfer funds into Palmcredit’s Access Bank Account.

Go to their app, select my loan, and choose to pay back the loan; you’ll find account details that belong to Palmcredit. Copy the details and do a transfer. But before making the transfer, make sure to contact the customer care line before directly sending the money.

Related: 12 High Income Skills in Nigeria to Acquire – 2022

After making your payment, WhatsApp (login mobile phone number/repayment time/repayment amount/payment proof) to +2349120143389.

Pay Using A Debit Card

- Log in to the Palmcredit App

- Visit My Loan.

- Choose the loan you want to pay for and enter your debit card information (card number, expiration date, CVV)

- Click Make your payment

PalmCredit USSD Code

Palmcredit does not provide USSD Code services for its loans. Their smartphone app is the only method to get a loan.

PalmCredit Loan Overpayment

If you overpaid your loans, particularly those paid via bank transfer, you must contact Palmcredit customer care so that the money may be returned to you. You will get a refund on your dashboard if you tell them and they validate the transaction, and you may withdraw this amount at any time.

Conclusion

While Palmcredit interest rates might be a little high, their application procedure is simple and secure. There are also various payment alternatives available to make your loan repayment easier. Overall, Palmcredit is a lending platform worth investigating.

Frequently Asked Questions

1. How Can I Apply For A Palmcredit Loan?

Follow these easy steps to apply for a loan on Palmcredit;

- Palmcredit may be downloaded from the Google Play store.

- Sign up and fill out the required information.

- Enter your bank details and apply for the loan you want.

- Fill up your personal information.

- Congratulations, you may now withdraw your funds.

2. Is Palmcredit approved by CBN?

Yes, they are. Newedge Finance Limited, the parent firm, is fully licensed by the CBN to operate as a finance company in Nigeria, meaning Palmcredit is also CBN-approved. Thus they are legitimate. This implies that their activities are completely monitored.

3. Does Palmpay Borrow People money?

Yes, they do. Palmcredit is an online loan business that aims to improve credit availability for financially underserved/excluded people in Africa. Moneylender loans are intended to be short-term loans to help you get through to your next payment.

4. How much interest does Palmcredit charge?

Palmcredit’s monthly interest rate varies from 4% to 4.7 percent, while the loan interest rate goes from 14% to 24%. Their loan amounts vary from N2,000 to N100,000, with terms ranging from 91 to 180 days.

5. Is Palmcredit And Newcredit The Same Company?

Although the firm (Newedge Finance) only stated Palmcredit as a single loan product, the Newcredit is also a loan product offered by Newedge Finance. Palmcredit and Newcredit have the same customer service phone number (017001000).

RELATED POST