I Need a Loan of 50000 Naira. (The Best Way to Get It)

Are you one among the million Nigerians saying, “I Need a Loan of 50000 naira.`?

If this is you. This article will hold you by the hand and show you how to get 5000 naira in Nigeria

Maybe you need this money for business or personal problems.

I’ll give you different ways you can come up with 50,000 naira instantly in Nigeria. As well as some success tips for taking a loan anywhere.

The three best places to raise a loan of 50,000 Naira in Nigeria are:

- Family and friends,

- Loan Companies,

- Loan apps.

Family and Friends

Call on family and friends to raise 50,000 naira instantly without BVN in Nigeria.

Here’s the best way to do this:

Take a pen and a paper and list ten people most likely to answer your call.

So instead of going to one person and saying I need a loan of 50000 naira. Ask 10 people to lend you N5k each.

But avoid going to them for 5k, rather ask them for 10k. If they make an excuse then reduce your offer to N5k.

It’s easier to get money from people this way.

Another way to raise this money is what I call the Jeff Bezos approach.

Jeff Bezos is the founder of Amazon. The Amazon Store.

When he was starting Amazon he called his family and friends and asked them to invest in his business.

Some did, others didn’t.

Do the same thing, but that’s if your intention is to use the money for business.

Related Articles: 7 Instant Loan without BVN in Nigeria

Loan Companies

The second way to raise 50,000 naira instantly in Nigeria is to visit some loan offices in your area.

Here are some requirements for borrowing from loan companies:

- An office or shop

- A guarantor

- Registration fee

- Your ID, passport, and BVN printout.

With these things in place, getting N50k is easy.

If this is your first time borrowing money you will feel anxious, afraid even. You will go to bed thinking about this money.

But the truth is, you have nothing to worry about. If you decide to take a loan from a loan office, always make sure the payment structure suits you.

Some loan offices will ask for weekly payments. I’ve always preferred monthly. It gives me breathing space and the ability to use the money for what I want.

Loan Apps

The third and easiest way to raise this money is to download a loan app on your phone and borrow from them.

I Need a Loan of 50000 Naira.

Which loan apps give 50,000 naira instantly in Nigeria?

Where can I get 50,000 instantly in Nigeria?

Which loan app can lend me 50k?

I need 50,000 urgently, where can I get it?

You’ll find this section helpful if you are searching for any of these questions.

Below are 12 tested loan apps that will lend you this money instantly.

Why I Choose These Loan Apps

A couple of years ago I was in a tight spot. I needed money to tackle some problems.

I took out a loan from these apps. So the information you find in this article are things that I have done and experienced.

Back in 2020, getting an instant loan was impossible.

There were no organizations or schemes that could offer you N50k in minutes.

Unless you decide to borrow from your friend, of course.

Loan offices available required guarantors and collateral before you could be considered.

With the emergence of these 12 loan apps. Access to credit in Nigeria has become easy.

Today, with just your phone and your BVN, you can get a loan of N50k+.

That is if you meet their requirements.

Eligibility Requirements

To be granted any loan in Nigeria, there are certain eligibility requirements to be met.

How well you meet these requirements determines how much loan you get.

The first things you’ll need are your

- BVN.

- A clear identity card, NIN, voter’s Card, or Driver’s License.

- A selfie of yourself.

- A smartphone.

- Must be 18+

If you have these things you’re good to go.

But before you do so, here are some tips that might be of help…

Success Tips for Borrowing from Loan Apps.

Alerts From an Active Bank Account

How many credit or debit alerts do you have on your phone? These messages give you access to bigger loans.

The higher the amount in your SMS alerts the easier it will be for you to get a loan of 50000.

Remember, I said SMS and not email.

So, if your intention is to go for a loan, the first thing you ought to do is to start saving SMS transactions on your phone.

When you receive alerts, save them.

Your Credit Score With Other Lending Offices.

It’s important to make sure your reputation with other lending apps is good.

You’ll have a hard time getting a loan from a loan app if you own any other app.

When you’re seeking a loan of 50k+, it’s important that you make this the first loan you’re taking from a loan app.

With the SMS transactions intact and your credit score without blemish, you’ll get a loan of 50,000 instantly.

Now let’s dive into the loan apps that will lend you this money:

12 Tested Loan Apps That Will Lend You 50000 Instantly in Nigeria

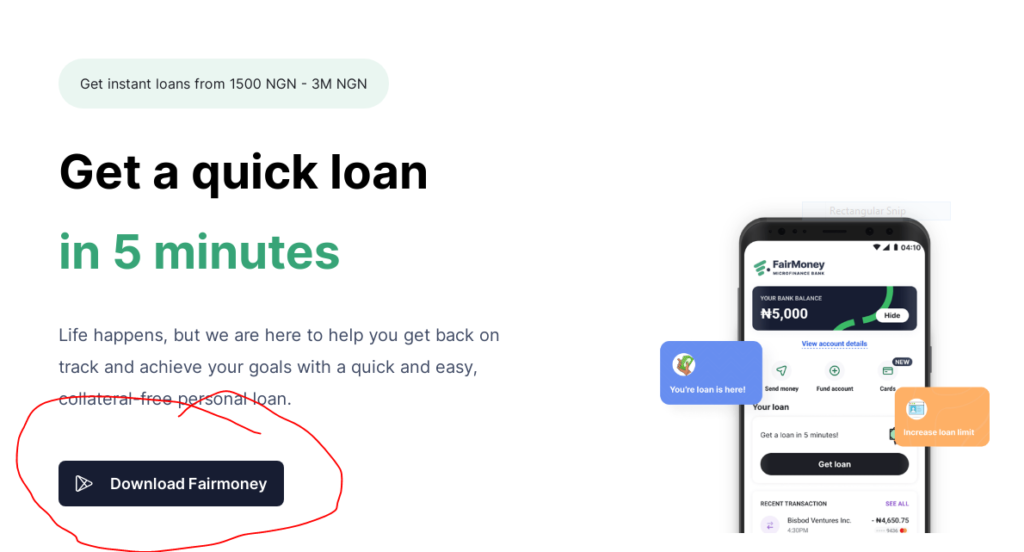

1. Fair Money Loan App

Fair money loan app is the best loan app on this list.

They have wonderful customer service and their loans have an extension feature.

This means you can extend the loan for a week or two weeks with 2k or 5k depending on the amount.

If you’re looking for where to get a loan of 50,000 instantly in Nigeria.

FairMoney loan app is my number one recommendation.

With SMS transactions saved in your phone and net credit history with other loan apps, you should be able to get a loan of 100k+ easily with Fair money.

Pros

Cons

2. Branch Loan App.

Branch is the first loan app that I began to use when I started borrowing money from loan apps.

I started using it after it was recommended by a YouTuber I was following.

It’s easy to get a loan of 50,000 with Branch if your credit score with other apps is good.

Pros

Cons

3. Okash

Okash was a part of Opay at some point but the two companies have now parted.

This was the second loan app that I took a loan from.

They’ll give you a loan of 50,000 instantly in Nigeria if you meet their requirement.

Once you download the app and apply for a loan you’ll be given different options for loans.

For the first time, your loan offer may not be up to the 50,000 you’re looking for.

Here’s what to do:

Take a loan of N20k and pay it back on time, this will unlock higher loan offers for you.

From time to time, log in to the app.

Act as if you want to take a loan, then abort the loan.

Once you do this a prompt will ask you why you did this.

Tell them it was because they didn’t give you the amount you were looking for.

This will make them increase the loan you’ve been given and you’ll be able to get access to the N50,000 loan.

Pros

Cons

4. PalmCredit

Palm Credit is another loan app that I had the chance to do business with.

You can get a loan for 50000 with PalmCredit but you’ll have to show them that you’re worth it.

Do this by borrowing a lesser amount and repaying on time.

This will make them offer you a higher loan option of up to 70k 0r 80k.

As always, you need to have banking SMS transactions saved on your phone.

It’s also important that you’re in a good place with other loan apps in the country.

The Palm credit app can be glitchy sometimes so be on the lookout for this, as you might repay your loan and it will show you that you’ve not repaid.

When something like this happens contact the customer care fast and tell them your problem.

They’ll deal with it.

Pros

Cons

5. Quick Check

This is a good loan app in Nigeria as they have the fastest loan processing time.

Quick Check can offer you a loan of 50k+ if your credit score shows that you’re worth it.

Taking a smaller amount of loan and then repaying on time is also helpful.

This increases the trust the company has in you.

Pros

Cons

6. Kashcash

This is a simple, easy-to-navigate loan app that can lend you 50,000 in Nigeria instantly.

Kashcash makes borrowing money easy and without any hassle.

They qualify clients with their ability to pay back rather than their reputation with other loan apps

If you take loans of lesser amounts and repay on time, you’ll be given access to loans of 50k+.

Pros

Cons

7. Renmoney

Renmoney is a good loan app that nobody talks about.

It’s difficult to get approved by Renmoney because they strictly abide by the rules of borrowing in Nigeria.

Nobody will harass you for failing to meet up with their terms. So it’s important that you meet up before they can give you any loan.

If you are in need of an app that can lend you N50k in Nigeria right now, I recommend you check them out.

Having a history of bank transactions SMS in your phone helps you.

Also, a good reputation with loan institutions in Nigeria is a plus.

Pros

Cons

8. Carbon

Think of Carbon as a digital bank. Very much like Kuda.

Like every other loan app on this list, Carbon will require your BVN for loan applications of 50,000 and above.

The BVN you submit will be used to check your credit history with other platforms.

It’s also important to have transactions that go into N100k+ saved in your phone.

This will help them see you’re a business person who can repay their loan.

Pros

Cons

9. Aella Credit

Aella app is one fintech app in Nigeria that doesn’t seem like a loan app.

When I was told about it, I didn’t think it was a loan app. I thought it was a digital bank.

The Aella app gives you access to loans of more than 50,000 if you meet their eligibility requirement.

If not, you could be told to contact them in a week or a month.

Their eligibility requirement remains the same: that you have SMS evidence of bank transactions.

You also need to have a great credit score. This will be checked with your BVN.

Pros

Cons

10. New Credit

The New Credit loan app is a subsidiary of Palm Credit. Both companies are owned by the same parent company.

The features of New Credit are similar to Palm Credit but they are different in their own ways.

New Credit loan offers are easy to navigate. Once you download the app, you see what I mean.

This is one wonderful loan app that can give you access to a loan for 50,000 in Nigeria instantly.

Pros

Cons

11. Easimoni

The Easimoni loan app will give you 50,000 naira instantly in Nigeria. It’s always better to take a lower amount of money and repay it.

If you need a loan of 50,000 naira, I recommend you take 10k first and repay in a few days. You’ll be given higher loan offers that can go as far as N100k+ if you do that.

Here’s a tip to help you increase your loan offer in this app:

(This tip will help you after you’ve taken your first loan and repaid it.)

Log in to the app and check all the loan offers you’ve been given. Act as if you want to take a loan but have no idea which one to take.

Then try to abort. The app will ask you why you want to cancel and will give you three options.

Click on “I want a higher amount.“

This will make them increase your loan offer the next time you log in to the app.

Pros

Cons

12. Bg Loan

This is the last loan app on this list.

With BGloan you can also get a loan of N50k in Nigeria.

Bg loan makes it super easy for people who want to borrow money as their app is light and easy to navigate.

You really don’t have to be tech-savvy to access a loan in this app.

Like every loan app on this list, all they require is your BVN and Identity card.

No collateral is required.

Pros

Cons

Before You Go

If you’re saying I need a loan of 50000 naira, you’re not alone. 2.3 million Nigerians owe banks.

Getting a loan is easy. With the three options mentioned in this article, even more so.

If your purpose for taking a loan is to solve a problem, maybe pay your house rent. I recommend that borrowing be your last resort.

Taking a loan is easy, but repaying this loan? Not so much.

Whenever you want to take a loan, make sure you have a repayment plan.

Without it, you may end up messing up your credit score, which will make it difficult for you to get access to good loan offers when you need them.

The best time to take a loan is when you want to invest in a business. This business will repay the loan easily.

Enjoyed this post on the I Need a Loan of 50000 Naira? Check out these: