How to Get Paga POS Machine in Nigeria. (The Best Way 2023)

Are you looking for how to get Paga POS machine? You’re not alone.

In Nigeria today, businesses are looking for new ways to make payment smoother for their customers.

One solution to this is the use of Point of Sale (POS) machines.

Paga is a fintech company that provides POS machines to businesses looking to simplify their payment processes. They have over 19 million users and 27000 agents all over the country

In this article, I will also talk about why you should choose a Paga machine over others.

I will also discuss the eligibility requirements, application process, and cost of getting a Paga POS machine.

By the end of this, you will have a comprehensive understanding of how to obtain a Paga POS machine and how it can benefit your business.

Let’s dive into it.

Six (6) Reasons Why Paga POS machine is a Great Choice.

Here are 6 reasons why you should choose a Paga POS machine over others.

- Accepts all cards

- Has a legit website

- POS is easily accessible

- Ease-of-use

- Supports their agents with funds.

- High-Profit Margins

Accept all card payments.

Paga POS machines accept every card payment. Mastercard, Verve, or Visa. Whatever your customers have is good to go.

It also accepts cards issued by digital banks like Kuda, and Fairmoney. This makes it super convenient.

While many POS machines accept many cards, not every one of them is as flexible as Paga.

This indiscriminate acceptance of all cards leads to increased customer satisfaction and loyalty.

High-performing website.

Paga has a very high-functioning website where you can contact them for any problem you have with your POS machine.

The accessibility of their customer care makes this company a great one to do business with.

Without assistance, you are able to visit the official Paga website and get your problems fixed in the FAQ section.

POS is Easily Accessible.

The Paga POS machine is easily accessible to anyone who wants to become an agent. Their website allows everyone from every corner of Nigeria to apply from where and when they want.

If you have the desire to start a POS machine in Nigeria, The Paga POS machine is a great choice.

Ease of Use

Paga ranks 6th in the list of best POS machines in Nigeria.

Not only does their Android POS machine offer amazing features, but it is also super easy to use.

With no glitches, smooth operation, and a great network service you can’t go wrong with a Paga POS machine.

High-Profit Margins

The cost of transactions with a Paga POS machine is reasonable compared to others.

Without a daily target, you have unrivaled freedom to do business the way you want to do, it and with who you want to do it.

You also receive your earnings when you want as opposed to some POS machines that require you to wait till the month’s end.

Who is Eligible for Becoming a Paga POS Agent?

Everybody above 18 is eligible for becoming a Paga POS agent but you must have a valid BVN and an active bank account.

Visit the Google play store on your Android device, and search for Paga.

Follow the instructions. Note that there are two Paga android apps on the play store.

(1) Paga

(2) Paga Agent

Download the Paga option if you are a first-timer, and the Paga Agent if you are already an existing agent with the company.

A functioning business is also a great boost in your application process.

Required Documents for Getting a Paga POS Machine.

- CAC certificate showing that your business is registered.

- Business bank account, or an active individual account if your business is not registered.

- Valid ID such as a driver’s license or passport.

- Proof of address, such as a utility bill or bank statement.

- Valid BVN

- Account Number, and

- Valid email address

If all this is available, you’ll be required to fill out an application form.

The company will then review your application before approving your request for a POS machine.

It’s important to note that the specific requirements for getting a Paga POS machine may vary depending on your location and other factors.

How to Apply for a Paga POS machine

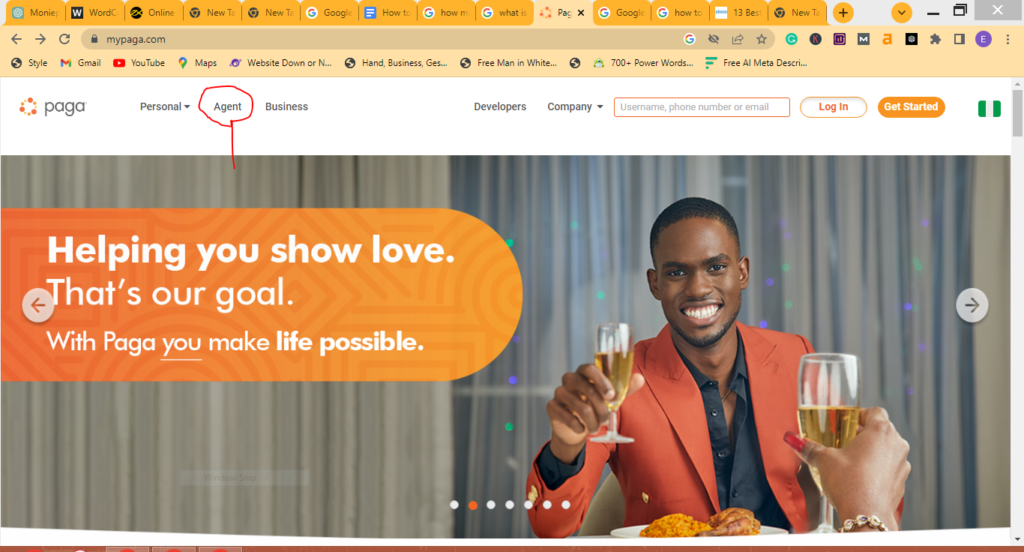

Visit the official Paga website Paga.com

Click on the AGENT option and you’ll be taken to a page where you be required to create an account.

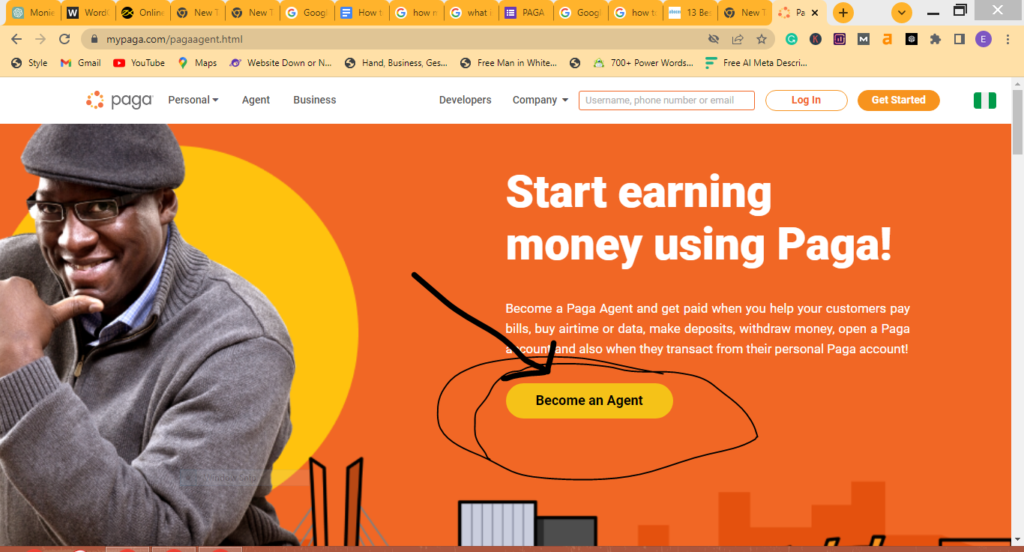

Clicking on the AGENT button will take you to another page.

This page is specifically meant for people like yourself who want to be a Paga POS agent.

If you click on the become an agent button, you will be taken to a page where you will be asked to fill out a form.

After submitting your application, wait for a response from Paga.

A representative from the company will contact you for additional information or to schedule a meeting.

Depending on your location and business type, Paga may require additional documents to complete your application.

Promptly provide all the necessary documents to avoid delays in the application process.

Once your application is complete, Paga will review it and determine whether to approve your request for a POS machine.

If approved, you’ll receive instructions on how to set up and use the POS machine.

ALSO SEE:

- How To Get A Moniepoint POS Machine In Nigeria – 2023

- How To Apply for OPay POS Machine in Nigeria (2023)

- 10 Best Bank POS In Nigeria – 2023 Ultimate Guide

How Long Does It Take to Apply and Acquire a Paga POS Machine

The application process for a Paga POS machine takes a few minutes to complete online. Acquiring it can take as much as 48 hours.

While this is the number promised by Paga on their official website, the true number varies depending on several factors such as location, availability, and verification process.

How Much Does Paga Cost and Charge in Nigeria

It costs N30,000 to get a Paga POS machine.

This is a cautionary fee to make sure the POS machine is safe with you.

It does not mean you have BOUGHT the machine.

You can return the POS machine in good form and get your money back.

Paga withdrawal charges

- For withdrawals of N1 – N20,000 Paga charges only 0.55% of the transaction amount.

- N30 flat on every deposit.

- You’ll be charged N5.5 for every N1000

- You’ll get charged a flat rate of N100 for N20,000 – N100,000

- Transactions above N100,000 is N150

You’ll get commissions for Data top-ups and utility bill payments from as low as 0.5% to as high as 2.8%.

Here is how to calculate Paga charges

Visit Google and give this prompt:

“What is 0.55% of 20,000?” If the transaction is 20,000.

Google will provide you with a fast, correct answer.

The answer to this one is 110. For every transaction above N20,000, you will be charged N110.

Training and Installation

Once your account has been fully set up, a Paga representative will be assigned to extensively train you on how the Paga agent works.

If you’ve been able to use any POS machine in the past, then this one is no different.

The Paga POS machine is even easier to use when compared to others. All you have to do is to follow the instructions. Back means back and transfer means transfer.

Usage and Troubleshooting

Paga does not offer the option of getting your POS machine fixed or serviced but they do have a robust customer care service that is there to help you through whatever problem you may be facing.

The machine is really durable so there is hardly any chance of it having any problems unless it is violently manhandled.

Two ways you can log a complaint to Paga

Paga has an FAQ section that is designed to answer the most recurring POS questions. It’s vigorous, you’ll find answers to lots of questions there.

Contact Paga through these channels:

- [email protected]

- Call: 07000007242

- Twitter: @mypagacare

- Facebook:@mypaga

- WhatsApp: 08099227242

- SMS: 09090027242

If you have any distress on your end you can also reach a POS specialist on this email [email protected]

Paga customer care WhatsApp number

The Paga Whatsapp customer care number is: 08099227242

If you fail to find satisfaction with this, visit their website and reach them via their email, call centers, or through their social media handles.

They are available 24/7

FAQS

Is Paga approved by CBN?

Yes, Paga is approved by the Central Bank of Nigeria (CBN). Paga is a licensed payment service provider in Nigeria, regulated by the CBN, and authorized to operate payment services in Nigeria.

Paga is London-based.

Which bank owns Paga POS?

Paga is a mobile phone-based payments platform that was first launched in Nigeria in 2011. It was founded in Nigeria in 2009 by Tayo Oviosu and publicly launched in 2011.

Paga was introduced to the market to include the large population of unbanked Nigerians by making their services easily accessible.

Is Paga legit?

Yes, Paga is legit. It is one of the strongest distribution networks for financial services.

Since its inception, Paga has processed over 15 million transactions worth over N154 billion and has over 800,000 active users.

Paga employs data encryption, two-factor authentication, and fraud prevention tools to protect its users’ information and transactions.

Does Paga offer commissions?

As part of its services, Paga offers commissions to its partners who make payments for utilities with their services.

The commission rates and terms of the referral program vary depending on the specific agreement between Paga and its partners.

Does Paga ask for your BVN?

Yes, they do. if you are setting up a business or individual account with Paga, they will run some compliance checks as required by law.

They’ll ask you to verify your identity using your Bank Verification Number (BVN).

Why Does Paga Ask for Your BVN?

The initiative put in place by the Central Bank of Nigeria is a measure to protect a customer’s account from unauthorized access and reduce fraudulent activities.

Your BVN helps financial organizations run checks from the BVN registry to make sure you are who you say you are.

While they have your BVN, it is unlawful to share this information with any third party. And they have no access to your bank accounts.

Final thoughts on How to Get Paga POS Machine

Congratulations! You have just learned how to apply for a Paga POS machine in a few simple steps.

With this device, you’ll easily accept payments from customers who prefer card transactions.

No more missed opportunities because of the inability to accept card payments.

Just follow the steps outlined in this article and you’ll be on.

Related Articles on POS Machines: